how are property taxes calculated in fl

Taxable Value X Millage Rate Total Tax Liability. The median property tax on a 18240000 house is 191520 in the United States.

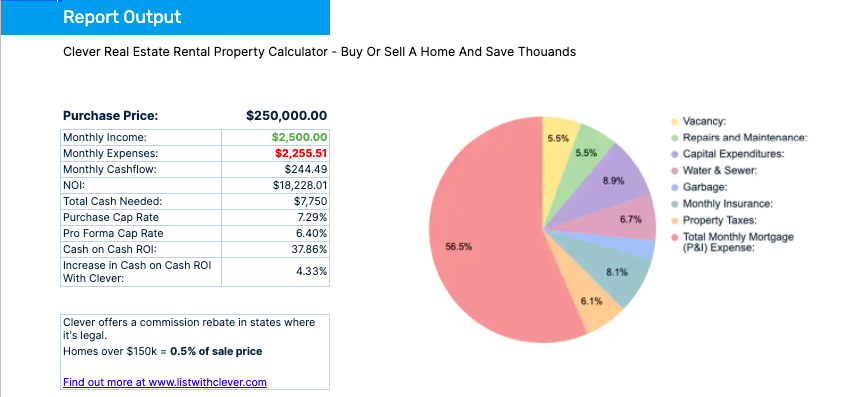

Rental Property Calculator Most Accurate Forecast

Please note that we can only estimate your property tax based on median property taxes in your area.

. The homestead exemption reduces your propertys taxable value by 25000 for all property taxes and by a further 25000 for property taxes besides school taxes. With each subsequent annual assessment your. This simple equation illustrates how to calculate your property taxes.

Beginning with the first year after you receive a homestead exemption when you purchase property in Florida an appraiser determines the propertys just value. Assessed Value - Exemptions Taxable Value. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. In Florida the first year a residence receives a homestead exemption the property tax appraiser assesses it at just or fair market value. Property taxes in Florida are implemented in millage rates.

Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to. The median property tax on a 18240000 house is 176928 in Florida. As you create a budget and save up to buy a home in South Florida its important to estimate every cost and fee youll have to pay.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. When it comes to real estate property taxes are almost always based on the value of the land. Florida real property tax rates are implemented in millage rates which is 110 of a percent.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Heres where you might be wondering How do I calculate my property taxes in Florida Placing a value on a piece of real estate is the first step in determining how much property tax the owner will pay on it. A number of different authorities including counties municipalities school boards and special districts can levy these taxes.

Property taxes make up a portion of your monthly mortgage payment and based on the size and condition of your home they may represent anywhere from a few hundred to a few thousand dollars. An additional 25000 exemption for properties with a value over 50k is also applied to all district taxes except for the school district millage. Tax amount varies by county.

For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of. Add the value of the land and any improvements to determine the. Therefore you must add the school taxes back in to the Gross Tax amount approximately 20000.

Property tax is imposed and paid at the county level when you buy a home in Florida and it is based on the just or fair market value of the property. Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value. Just Value - Assessment Limits Assessed Value.

To calculate the property tax use the following steps. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Property taxes in Florida are implemented in millage rates.

After the first year the assessed value cant increase more than three percent of the Consumer Price Index CPI whichever is lower. It also makes you eligible for the Save Our Homes assessment limitation which places a cap of 3 or the rate of inflation whichever is less on the annual increase in the assessed. One mil equals 1 for every 1000 of taxable property value which is after exemptions if applicable.

Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected. Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes. The median property tax in Florida is 097 of a propertys assesed fair market value as property tax per year.

The property appraiser does not determine the property tax rate or the amount of property taxes levied. A number of different authorities including counties municipalities school boards and special districts can levy these taxes. A propertys value is not based solely on the specific purchase price of that property.

Because each years property value stands alone it is difficult to estimate taxes before annual property values and millage rates are established. Find the assessed value of the property being taxed. As we have written about previously the Florida Homestead Exemption reduces the assessed value of a property up to 25000 for permanent Florida residents that qualify.

This equates to 1 in taxes for every 1000 in home value. The millage rate for Boca Raton is 18307 per 1000 of value so you are paying 1831 for every 1000 in taxable. Every county in Florida pays a different tax rate because each county has its own property appraiser.

The Florida Department of Revenue the Department reviews the property tax rolls of each county in July and August of every year.

Florida Property Tax H R Block

Calculating Property Tax Using Mills Youtube

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Boxes Easy

First Time Home Buyer Rent Vs Buy Calculator Mls Mortgage Mortgage Real Estate Investing Rental Property Free Mortgage Calculator

Looking For Android App With Features Like Emi Calculator Loan Calculator Car Loan Home Loan Emi Loan Tracker Educational Loan Calculator Finance Loans Loan

How To Calculate Property Tax And How To Estimate Property Taxes

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Real Estate Taxes City Of Palm Coast Florida

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How To Calculate The Gravel Needed Around A Swimming Pool Swimming Pools Pool Swimming Pool Decks

12552 Highfield Cir Lakewood Ranch Fl 34202 Https Tours Pinnaclerealestatemarketing Com 883853 Referrer Real Estate Photography Selling House Lakewood Ranch

What Is A Homestead Exemption And How Does It Work Lendingtree

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

Property Taxes How Much Are They In Different States Across The Us

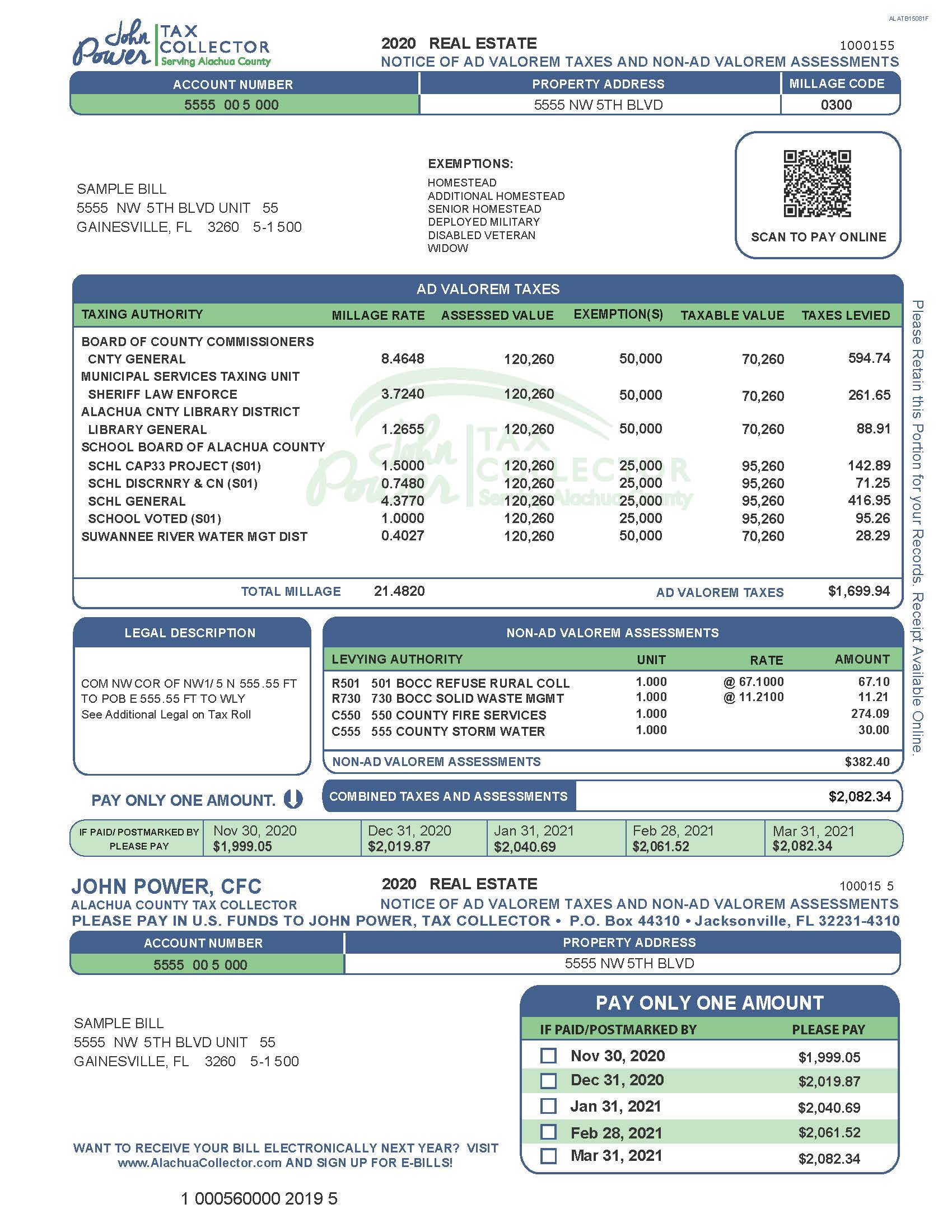

A Guide To Your Property Tax Bill Alachua County Tax Collector

How To Calculate Rental Property Cash Flow A Comprehensive Guide Rental Property Rental Property Investment Real Estate Investing Rental Property

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)